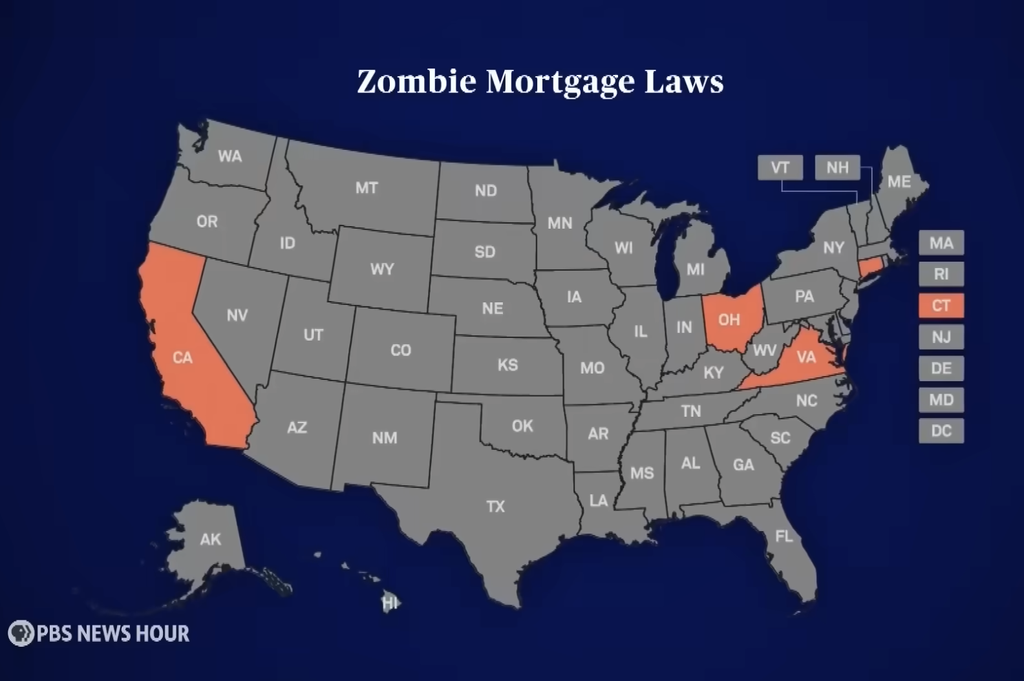

How ‘Zombie Mortgages’ Are Coming Back to Haunt Homeowners Years Later

Zombie mortgages are resurfacing years later. In this lesson, students examine how these debts reappear and what they reveal about housing policy and consumer protections.

Photo credit: PBS

Share

February 9, 2026

Zombie mortgages are resurfacing years later. In this lesson, students examine how these debts reappear and what they reveal about housing policy and consumer protections.

Share

Note: If you are short on time, watch the video and complete this See, Think, Wonder activity: What did you notice? What did the story make you think about? What would you want to learn more about?

They’re called “zombie mortgages” — debts that homeowners thought were forgiven long ago, only to learn that they still exist and could cost them their homes. Economics correspondent Paul Solman and producer Diane Lincoln Estes report on these back-from-the-dead debts, in partnership with the documentary news group Retro Report.

View the transcript of the story.

second mortgage — a loan taken out by the homeowner using their house as collateral (item of value) while they still have another loan secured by their house

lien — a right to keep possession of property belonging to another person until a debt owed by that person is discharged

retroactive interest — interest calculated on the full balance from the original purchase date, not just the portion that hasn't been paid, often at exorbitant rates

foreclosure — process that permits the bank to sell a person's home to pay back their debt if the homeowner defaults on their mortgage payments

Watch Retro Report's story below on the 2008 financial crisis and check out the accompanying lessons (you will have to login - it's free!): Lesson Plan: Accountability and the Great Recession: A Financial Crisis Inquiry and Lesson Plan: the 2008 Financial Crisis.

Want to see more stories like this one? Subscribe to the SML e-newsletter!

Republished with permission from PBS News Hour Classroom.